reit dividend tax uk

9100 - 2000 7100 total taxable income from dividends. A corporate shareholder or a shareholder treated as a company for treaty purposes wherever tax resident who holds 10 or more of the shares or voting rights in a UK REIT is regarded as.

Emergence Of Real Estate Investment Trust Reit In The Middle East

In the following instances however REIT.

. EPIC Name Market Cap m Dividend Price to Book Sectors. Any non-PID dividends will be treated the same as ordinary. You do not need to pay taxes on dividends you generate from your individual savings accounts ISAs.

The REITs voting stock except in the case of Jamaica and no more than 25 of the REITs income consists of dividends and interest. You do not need to tell HMRC if your dividends are within the dividend allowance for the tax year. Hence you do not need to pay taxes on the REIT dividends you get from your ISA.

Our REITS Table shows 45 UK-listed REITs Click on the REIT to see more Yahoo Finance Data. A REIT are not eligible for the annual dividend tax allowance which is 2k in 202122. For dividends categorized as ordinary income the rate at which you are taxed will vary based on your income and tax bracket.

It offers exposure to a portfolio of Urban and Big box warehouses in Europe with a combined value of 184b. If you have received over 10000 in dividends in the tax year. Youll need to fill.

Part 12 of the Corporation Tax Act 2010 provides for a special tax regime for Real Estate Investment Trusts UK-REITs. The largest UK REIT is Segro SGRO with a market cap of 124b. For example if your taxable income was 50000.

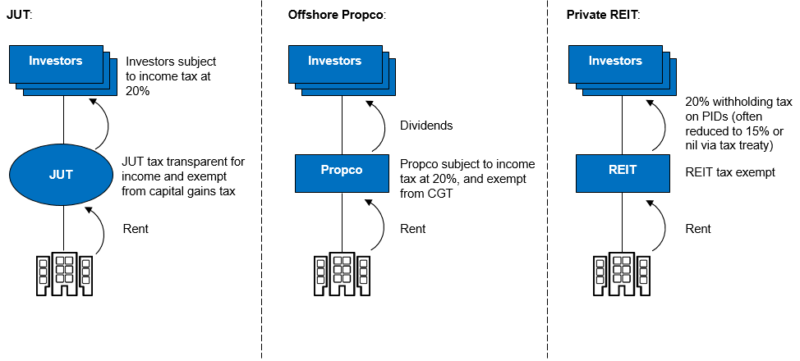

Investor After tax return from UK company After tax return from UK REIT Enhancement of return UK. 30 tax rate if shareholder owns 25 or more of. PID dividends are normally paid after deduction of withholding tax at the basic rate of income tax 20 which the REIT pays to HMRC on behalf of the shareholder.

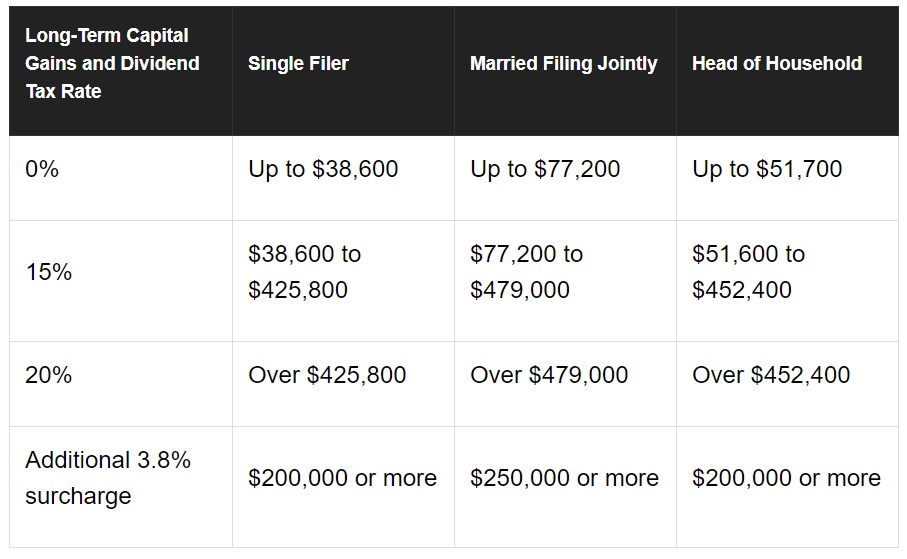

REIT dividends and UK tax Scrip dividends IR contact information FAQs IR calendar Regulatory news Share price. The highest effective tax rate on qualified REIT dividends is usually 296 percent taking into account the 20 percent deduction. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income.

Tax rate on dividends over the allowance. Delayed share data provided by. This corporation tax is paid by the company before any dividends are paid out to investors.

To work out your tax band add your total dividend income to your. Since Sandras earnings are within the basic threshold she will pay. Please note that the tax-free dividend allowance does not apply to the PID element of the dividends.

Sandra now deducts her dividend allowance. A UK-REIT is either a company or group that carries on a. A normal UK company is required to pay Corporation Tax on profits at a rate of 19.

Uk Reits Property Investing Like A Boss Foxy Monkey

U S U K Tax Treaty Ratified Nareit

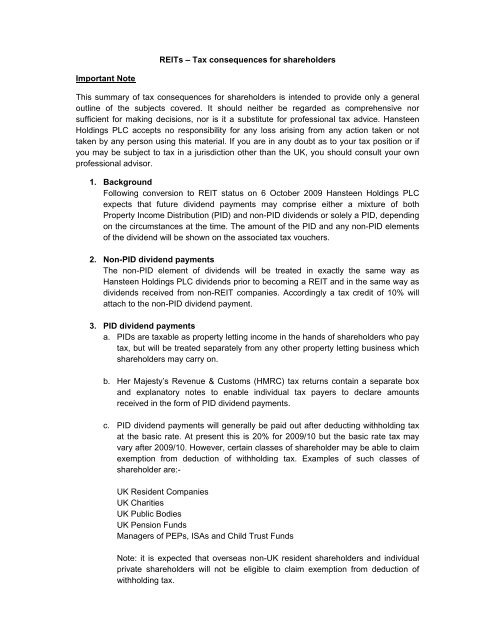

Reits Tax Consequences For Shareholders Hansteen Holdings Plc

Are Reits As Attractive As We All First Thought Financial Times

5 Popular Uk Reits Among Investors In October 2022

Uk Reits An Attractive Vehicle For Uk Property Investment Pwc Uk

How Dividend Reinvestments Are Taxed

Tax On Reit Dividends And Uk Dividend Tax Panda Boss

The Continuing Rise Of The Reit

Spirit Realty Capital Inc Announces 2021 Dividend Tax Allocation

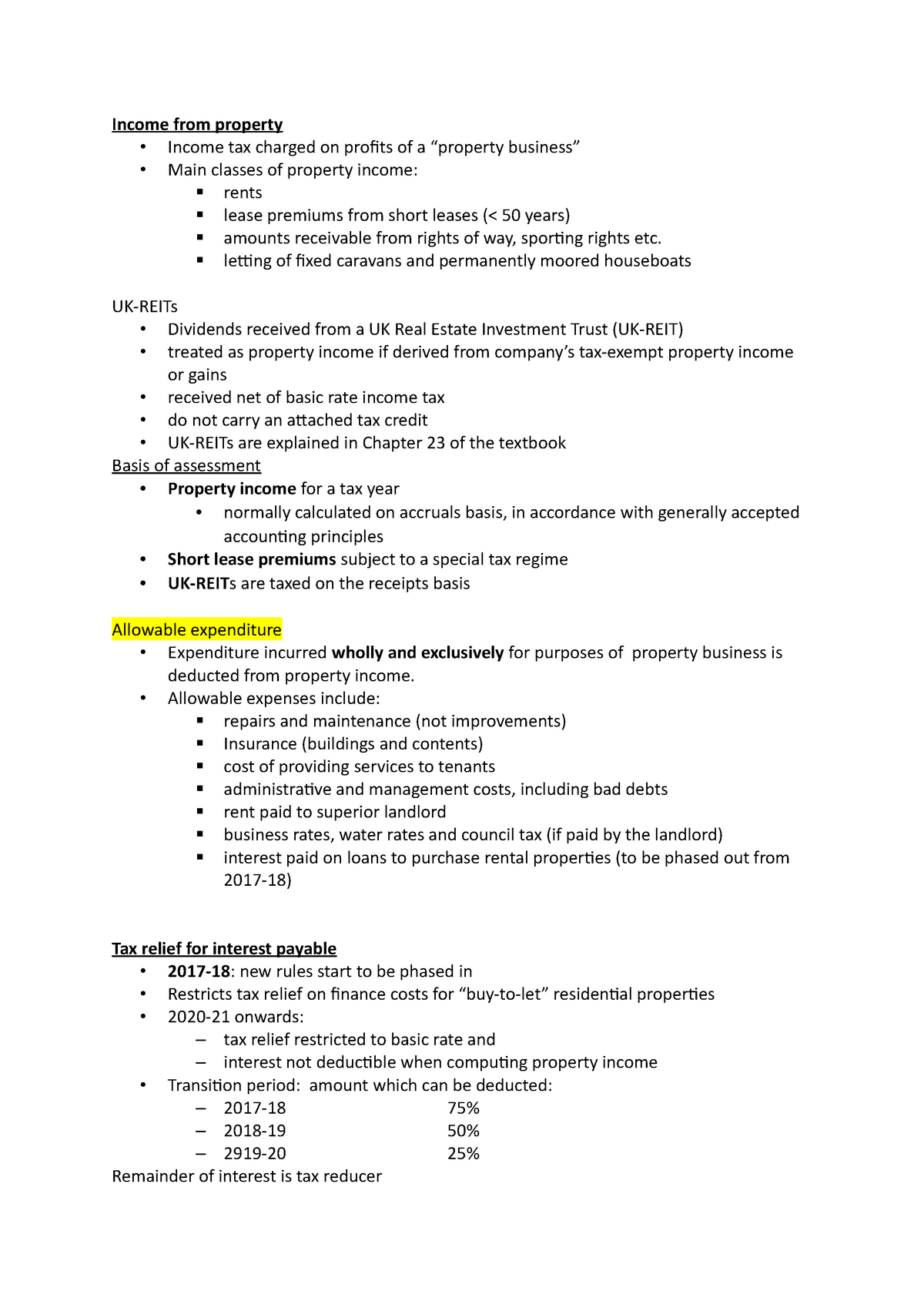

Taxation 2 2 Lecture Notes 2 Income From Property Income Tax Charged On Profits Of A Studocu

3 Tax Smart Alternatives Cohen Steers

Reits Real Estate Investment Trusts Explained

The Uk Asset Holding Company Regime A Quacking Idea

Will Property Investors Rush To Reits As Fca Tightens Open Ended Rules Citywire

.png)

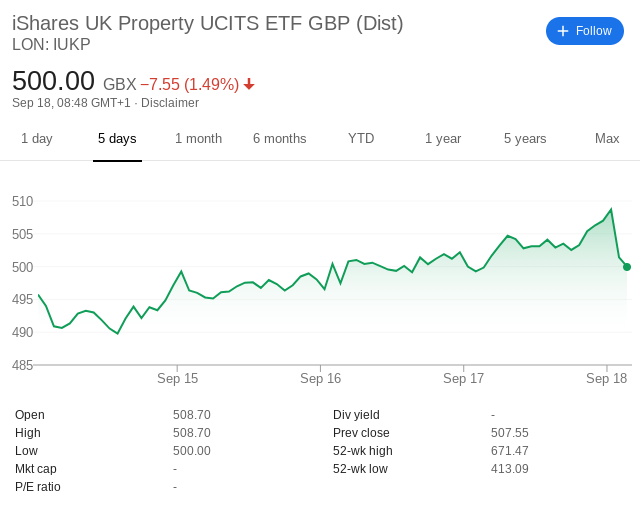

Are These The Best Reit Stocks Etfs In The Uk Ig Uk

Tax On Reit Dividends And Uk Dividend Tax Panda Boss

Some Info I Looked Into On Elite Commercial Reit Investment Moats